Other Metals: Diversify with Platinum & Palladium

While gold and silver are the cornerstones of precious metals investing, a strategic portfolio can benefit from the unique characteristics of platinum and palladium. These metals offer distinct industrial applications and market dynamics, presenting compelling opportunities for sophisticated investors.

Platinum: A Scarce and Strategic Metal

Platinum represents a specialized segment of the bullion market, valued for its rarity and diverse utility. Its profile differs notably from gold and silver:

Platinum's primary applications are in automotive catalysts, healthcare equipment, and jewelry, creating a consistent base of demand alongside its investment appeal..

Historically, platinum’s price has demonstrated lower volatility compared to other industrial precious metals, providing a stabilizing influence within a diversified portfolio.

Its market performance often has a low correlation with gold, making it an effective tool for risk diversification.

As a globally traded commodity, platinum bullion offers high liquidity through established markets.

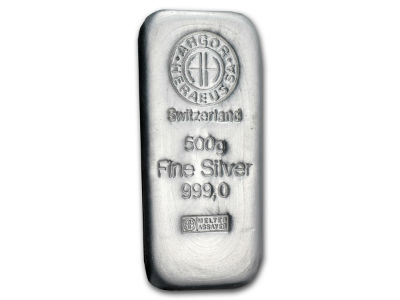

Step up your silver investment with this substantial 500-gram bar from the renowned Swiss refinery Argor-Heraeus. Striking the perfect balance between size and affordability, this bar offers a cost-efficient way to add significant weight and proven quality to your precious metals portfolio.

Key Features:

Purity: 0.999 Fine Silver

Weight: 500 grams

Refinery: Argor-Heraeus SA, Switzerland

Assay: Each bar is individually sealed in protective, tamper-evident packaging to guarantee its authenticity, weight, and purity.

Crafted with Swiss precision, this bar combines the impeccable reputation of Argor-Heraeus with the enduring value of silver. It is an ideal choice for investors seeking a highly liquid asset from one of the world's most trusted names in precious metals.

The Platinum Britannia is a flagship bullion coin from The Royal Mint, representing the pinnacle of British coinage in one of the world's most prestigious precious metals. Struck from one troy ounce of 99.95% fine platinum, this coin combines exceptional purity with a design rich in national symbolism, making it a premier choice for investors and collectors alike.

Key Features:

Purity: 99.95% Pure Platinum (999.5 fine)

Weight: 1 Troy Ounce (31.1 g)

Face Value: £100 (Legal Tender of the United Kingdom)

Design Details:

Obverse (Heads): This side features the iconic figure of Britannia, the female personification of Britain. She is depicted standing guard, holding a trident and a shield, symbolizing Britain's maritime heritage and strength. The word "BRITANNIA" is inscribed above her. The coin's year of issue, weight, and purity are inscribed on the edge.

Reverse (Tails): The reverse bears the fifth and final definitive effigy of the late Queen Elizabeth II, created by renowned engraver Jody Clark. The portrait is encircled by the Latin inscription "ELIZABETH II · D · G · REG · F · D" (Elizabeth the Second, by the Grace of God, Queen, Defender of the Faith) and the coin's face value of "100 POUNDS".

As legal tender backed by the British government, the Platinum Britannia offers a secure and tangible asset, renowned for its beautiful design and impeccable quality from The Royal Mint.

Since its introduction in 1989, the Platinum Maple Leaf has stood as a pinnacle of purity, security, and Canadian craftsmanship. Struck by the renowned Royal Canadian Mint from 99.95% fine platinum, this sovereign bullion coin offers investors and collectors a premier asset backed by the Canadian government. The 2025 issue continues this legacy, integrating breathtaking design with state-of-the-art authentication technology.

Key Specifications:

Purity: .9995 Fine Platinum

Weight: 1 Troy Ounce (31.107 g)

Face Value: $50 CAD (Legal Tender in Canada)

Mint: Royal Canadian Mint

Security: Bullion DNA™ Authentication Program

Unmatched Security and Artistry

The Platinum Maple Leaf is renowned for its advanced security features, making it one of the most protected bullion coins in the world.

Reverse: Displays the iconic, elegantly detailed maple leaf—a symbol of Canada for over 40 years. The coin's weight and purity are prominently featured. The background showcases fine radial lines, a precisely machined pattern that creates a unique light-diffracting effect.

Obverse: Features the dignified effigy of His Majesty King Charles III, crafted by Canadian artist Steven Rosati, along with the coin's legal tender value.

The Bullion DNA™ Security Program

Introduced in 2015, this groundbreaking program provides unparalleled authentication:

Micro-Engraved Privy Mark: A tiny maple leaf is laser-engraved on the coin, visible only under magnification.

Hidden Date: Etched within this privy mark are the digits "25," indicating the year of production.

Registered Authentication: Each coin's unique micro-engraving is encoded, scanned, and recorded by the Mint, creating a secure "DNA" profile for future verification.

Packaging

For secure storage and handling, these coins are typically available:

In protective flips for individual coins.

In mint-sealed tubes for multiples of 10.

With its exceptional purity, sovereign guarantee, and revolutionary security features, the 1 oz Platinum Maple Leaf represents the perfect synthesis of investment-grade metal and cutting-edge innovation, solidifying its status as a top choice for discerning investors across North America and the globe.

Featured Platinum Bullion Coins

Celebrated for its impeccable Austrian Mint quality and elegant design.

A leading bullion coin from Canada's Royal Canadian Mint, renowned for its purity.

An annual series from The Perth Mint, known for its fresh designs and high liquidity.

A prestigious series from The Royal Mint featuring iconic British heraldic figures.

Palladium: High-Growth Industrial Metal

Palladium is a metal defined by its critical industrial role, which directly drives its market value. Its investment profile is marked by:

Over 80% of palladium demand originates from the automotive sector for catalytic converters, tying its value directly to global industrial production and environmental regulations.

Palladium is known for experiencing significant price movements, offering high-return potential alongside increased risk, driven by supply constraints and industrial demand shifts.

With limited global production concentrated in a few regions, palladium is one of the rarest precious metals, underpinning its long-term value proposition.

Featured Palladium Bullion Coins

The most widely recognized palladium bullion coin, offering high purity and liquidity.

A historically significant series known for its intricate design and substantial mintage.

Strategic Allocation: Choosing the Right Metal

Selecting the appropriate metal depends on your investment objectives and risk tolerance:

Gold remains the premier asset for hedging against inflation and geopolitical uncertainty.

Silver offers an accessible entry point with significant upside potential, supported by both industrial and investment demand.

Platinum and Palladium are specialized assets for investors seeking to capitalize on unique supply-demand dynamics and enhance portfolio diversification, acknowledging their higher volatility.

Why Consider Platinum and Palladium?

Including platinum and palladium in a portfolio provides exposure to distinct market drivers not always present with gold and silver. They represent a strategic choice for investors aiming to capitalize on industrial growth and rarity. We recommend these metals to investors who have a firm understanding of market cycles and a higher risk tolerance.